What’s the current thinking on peak oil? Your column six years ago led me to think the petroleum tap was running dry and we’d soon be trading in our cars for bikes and roller skates. Now high-profile opinion types like David Brooks and Fareed Zakaria are making it sound like we’ve got nothing to worry about, what with fracking and dropping natural gas prices. Were you being an alarmist then, or are the optimists kidding themselves now? — David Wargo

[hr]

Me, alarmist? Never. I just emphatically point out the facts. However, the situation has changed since my 2006 column on peak oil. Let’s take it step by step:

1. Peak oil is the point when oil production stops increasing and starts falling, with potentially dire economic consequences. That day will arrive eventually; the question is when.

2. Pessimists note oil production is tapering off or declining in many parts of the world and anticipate a peak soon — not long ago, some thought it would happen any day. However, people have been making gloomy forecasts for years, and virtually none have panned out.

3. The exception was in 1956, when geophysicist M. King Hubbert introduced the concept of peak oil in a famous paper. Drawing on analyses of U.S. petroleum reserves plus some informed conjecture, he correctly calculated domestic oil production would peak in 1970.

4. Global petroleum estimates were much fuzzier. Hubbert thought the “ultimate recoverable resource” for world oil was 1.25 trillion barrels; most reports I see now say it’s at least 2 trillion, perhaps much more. His prediction that global oil production would peak in 2000 was accordingly way off.

5. The official word is we haven’t reached peak oil yet, and probably won’t for a while. The U.S. Energy Information Administration says world oil production was about 85 million barrels per day in 2011, and predicts a steady if slowing increase to 99 million barrels per day by 2035 — as far out as the forecast goes.

6. Now for the part no one anticipated in 2006: U.S. energy production has jumped in the last few years due to improved recovery techniques such as hydraulic fracturing of shale rock, also known as fracking. EIA statistics show a 24 percent increase in U.S. production of petroleum and natural gas between 2006 and 2011. Domestic natural gas is now so abundant the EIA predicts the U.S. will be a net exporter by 2022.

7. This puts matters in a new light. Oil has been the focus till now because transportation relies heavily on liquid fuels — currently natural gas is mostly used for heating and electricity generation. However, it can also be used to power vehicles — some transit agencies use compressed natural gas to fuel buses. So we should really be talking about peak oil and gas. When might this occur?

8. My assistant Una dug through the statistics and established the following. First, as of 2005, ultimate recoverable natural gas in the world was between 8.5 and 12.5 quadrillion cubic feet. Second, between pre-fracking 2000 and frack-happy 2010, U.S. proved natural gas reserves increased 72 percent.

9. We then commenced arguing. I noted fracking was now mainly confined to the U.S., due partly to scruples about contaminated groundwater and such. Let’s suppose the world gets over all that and starts fracking as much as we do, with the result that world recoverable gas reserves jump at the same rate as U.S. proven reserves. That would give us 17 quadrillion cubic feet.

10. This was too cavalier for Una. The most she’d concede was 12.5 quadrillion feet, the equivalent of 2.3 trillion barrels of oil.

11. Fine, I said. But another fossil fuel can also be liquefied and used for transportation in a pinch, namely coal. What’s the recoverable world stash of that? One trillion tons, Una said, the equivalent of 3.3 trillion barrels of oil.

12. By now it had dawned on us the limit of importance wasn’t oil, or oil plus gas, but all fossil fuels taken together. We computed global recoverable fossil fuels as follows: 2 trillion barrels of oil + 2.3 trillion barrel-equivalents of natural gas + 3.3 barrel-equivalents of coal = 7.6 trillion barrel-equivalents total.

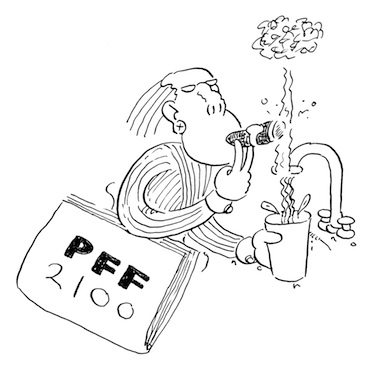

13. Finally we (well, I) took a stab at estimating peak fossil fuels, which I called PFF, or “piff.” Much depends on developments in the world economy, conservation, alternative fuels, and who knows what else, but I optimistically predicted PFF wouldn’t occur till 2100.

That kicks the can down the road. However, let’s remember a few things. One, if we’ve burned through half the planet’s fossil fuels by 2100, our problem won’t be global warming, it’ll be global scalding. Two, fossil fuels provide the bulk of the energy for everything — transportation, heating, electricity. Looked at in that light, 2100 isn’t that far away.

The market will remind us. Although natural gas now is cheap, long-term energy prices due to growing world demand will inexorably rise. That noise you hear? Perhaps you thought it was the ringing of the cash register. Ah, no. It’s tick tock.

— CECIL ADAMS

Send questions to Cecil via straightdope.com or write him c/o Chicago Reader, 350 N. Orleans, Chicago 60654. Subscribe to the Straight Dope podcast at the iTunes Store.

As it so happens my son is an expert on peak oil. He is at UCSB at the Bren School of Environmetal Engineering. His name is Tariel Morrigan. Google him and see his already published papers on the subject.

Oil will only keep coming out of the ground as long as it’s cheaper than other forms of energy. As the combined capacity of installed solar installations becomes significant, expect a reduction in demand for fossil hydrocarbons. As oil prices continue to increase, solar capacity will expand until most energy comes directly from sunlight. That is to say, the right side of the Hubbert curve will be cut off, ultimately leaving more oil in the ground than would be expected if it were the only energy source. There is so much sunlight falling on the Earth every hour that the… Read more »

adam, that would be nice but since we are dealing with an impending oil supply glut, prices can hardly be expected to increase in the next few decades. my concern is that the recent estimates indicate that the point of “peak oil” won’t happen this century. that’s why we desperately need carbon tax or credit policy to implement a sustainable energy infrastructure. sadly it won’t happen anytime soon without policy intervention.

A house cat is smart enough not to take a crap in it’s own drinking water; humans, not so much. Women and animals are experiencing spontaneous abortions after the water table becomes contaminated. The documentary, “Gasland” mentioned 80 contaminants in the water table, including Benzene: http://en.wikipedia.org/wiki/Benzene#Health_effects You can see the “jellyfish” that one woman gave birth to, in “Weibo’s War”: http://www.youtube.com/watch?v=dnBibPMCcME From the documentaries, “Blue Gold” and “A World Without Water” only 2% of the water on the planet is drinkable. Desalination plants are too expensive for corporations to build. Meanwhile, the control freaks who run the world are busy… Read more »

What is the purpose of increasing outputs at this point? It’s a game for fools. Can’t people see that we are only accelerating depletion. This is not the way that we are going to achieve a controlled descent. The higher we push the peak the steeper the downward slope will be.

sallyandjane, i completely agree, not to mention the climate consequences. only a global carbon tax or carbon credit system could slow things down, combined with tax incentives for sustainable energy.

Interesting analysis. It would be good if Una were able to fold in the conversion costs. I.e. net out the barrel of oil equivalents required to convert coal to useable oil. I suspect big challenges which are missed today is the amount of energy required to extract the unconventional fuels and process them into something we can use.

http://www.nytimes.com/2012/11/13/business/energy-environment/report-sees-us-as-top-oil-producer-in-5-years.html?_r=0

“America is now a net energy exporter again.” martincomet, you do understand that America is not a net oil exporter? It is a net petroleum products exporter, and the volume is tiny compared to the something like 8 million barrels of oil per day that it still imports. Thee has been a small recent increase in oil output, but comes the next (stage of the) recession the price of oil will drop and so will the output of this expensive-to-produce oil. Natural gas is another story that will likely soon end in tears. There is no energy fairy, and America… Read more »

landbeyond, i do understand the difference, that’s why i wrote ‘energy’, not ‘oil’.

nobody’s head is in the sand except yours if you believe that we are ‘slipping into an energy crisis’ anytime soon. the numbers say differently.

DaShui, the devil is in the details. By some projections the export market is supposed to decline twice as fast as conventional production. Who in the west doesn’t import oil? It’s a pretty small club. Walkable neighborhoods, mixed use zoning, electrified rail transit. It’s not like I don’t have answers!

durango kid, the price of oil is not only determined by supply and demand. geopolitical events as well as speculative trading can be the overriding factors in the short and mid term. with monetary easing policies worldwide (money printing) investors are fleeing into commodities like oil and keep the prices high. the current relative high price cannot be explained by supply demand ratios. transportation is also an issue, you cannot move the north dakota oil (where production is skyrocketing, they are about to overtake Qatar in production!) to california or the east coast. but within the next few years we… Read more »

Don’t forget about peak exports.

A couple of things to keep in mind about “gigantic” oil finds. The world goes through about 1 billion bbls every eleven days. Finding a 1 billion barrel reservoir is nice, but nothing to really crow about. Also, consider the production rates of some of the larger unconventional finds. Not too impressive. And the cost per barrel. For some deep water oil, prices below $60/bbl spell trouble. Compare that with a buck or two for some onshore oil in the middle eastern oil patch. Then there are the expanding reserves and refinery gains that amount to a lot of fuzzy… Read more »

martincomet…Reserves are not production and much of them never will be. The resources needed to drill and complete the shale wells are massive and of course, being human we are drilling the best spots first. America will never again produce more oil than we did in the 70’s even with your new massive reserve “discoveries”.

massbytes, in general you are correct. but i was addressing the idea that “peak oil” is imminent or has already happened by pointing out the proven reserves that are currently multiplying. but new drilling technologies have cut the costs of extraction substantially. of course the market will determine what is feasible to extract but production has and is growing fast right now and as long as oil prices stay high it is very much feasible for companies. it certainly is now with oil prices still above $80, for the first time since 1949, America is now a net energy exporter… Read more »

Natural gas is the future of energy. It is replacing dirty old coal plants, and dangerous expensive nuclear plants. It will fuel cars, vans, buses, locomotives, aircraft, ships, tractors, engines of all kinds. It costs far less. It will help keep us out of more useless wars, where we shed our blood and money. It lowers CO2 emissions. Over 2,400 natural gas story links on my blog. An annotated bibliography of live links, updated daily. The big picture of natural gas.

Ron Wagner